- Richard de Haan

- Business Legalities, Consumer Protection Laws, Data Protection Laws, Digital Business Law, eCommerce, eCommerce Compliance, eCommerce Laws, eCommerce Legal Guidelines, Legal Requirements, Online Business, Online Retail Legalities, Online Store Regulations, Website Compliance, Website Privacy Policy, Website Terms and Conditions

- 0 Comments

- 2157 Views

Operating an e-commerce website creates plenty of opportunities, but it also comes with legal responsibilities. For instance, offline businesses are familiar with the legal obligations of running a brick-and-mortar store, but they often forget that similar obligations apply in the online e-commerce environment.

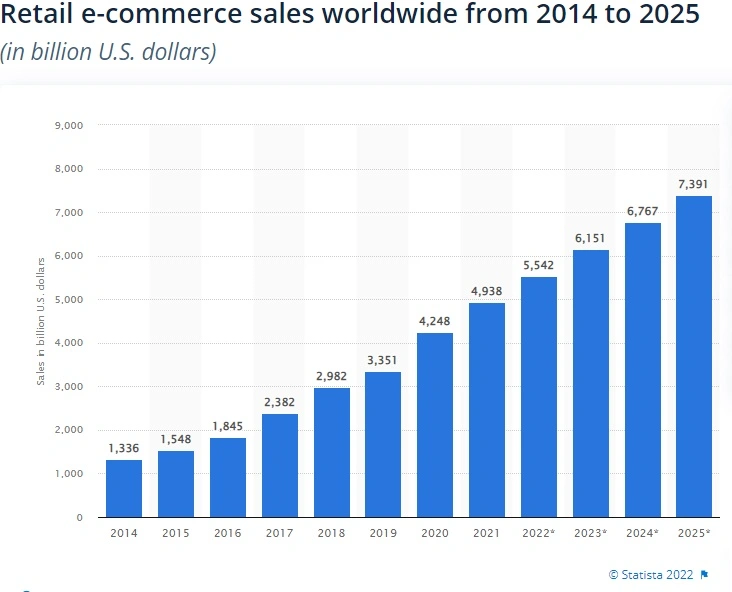

How are traditional businesses faring against online retailers? While some consumers still prefer to shop in-store, particularly for certain types of goods, there’s no doubt that online shopping is taking over. Although there was a sharp decline in online sales after pandemic restrictions were eased, online spending still remained higher than it was before Covid-19 hit.

Whether you’re looking to maintain your brand reputation and grow your e-commerce business, it’s important to introduce a friction-free returns process, manage your cash flow, and reduce process liabilities. This post offers some top tips for avoiding common e-commerce pitfalls.

There are many laws that apply to e-commerce websites, including:

1. Data Protection and Privacy Laws

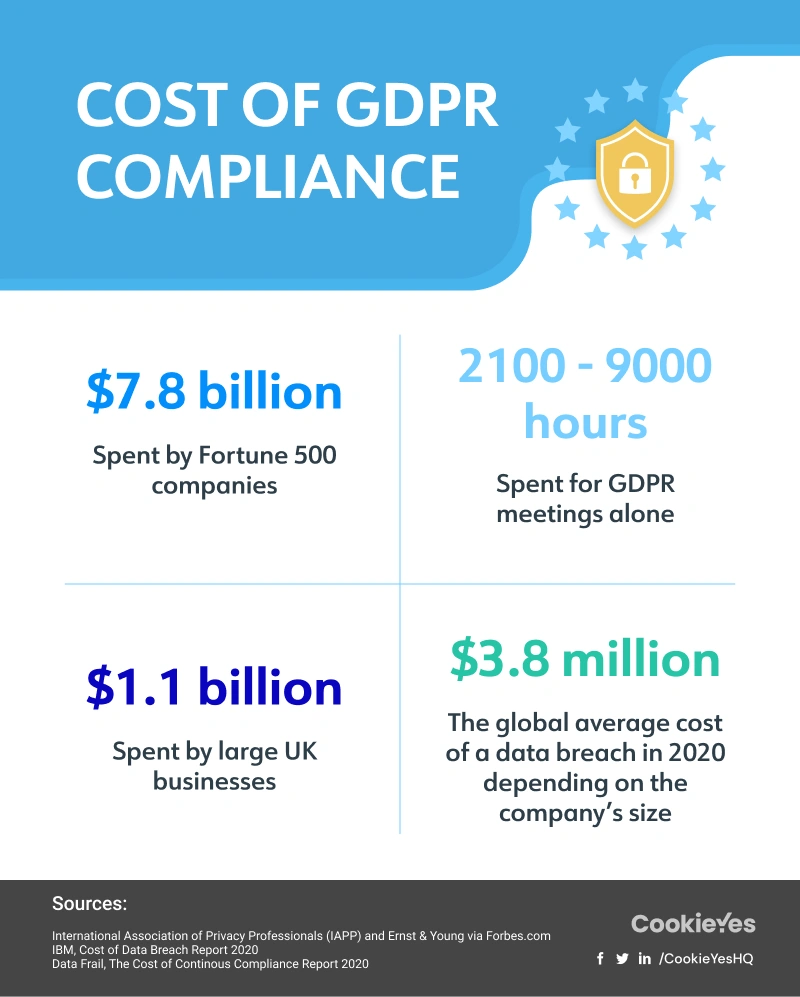

These laws ensure that customer information is handled with care and transparency. The General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are examples of these laws.

Compliance can be quite time-consuming, as you’ll need to conduct a mapping exercise, understand where your data flows, and identify all the third parties that have access to it. Doing this once and getting it right can pay off in the long run, helping you use GDPR as a tool rather than viewing it as just a regulatory hurdle.

Does GDPR and data protection have a huge impact on e-commerce businesses? Their impact is far-reaching, covering aspects such as cookies, your choice of courier, your payment gateway, and more. Getting it right can bring significant benefits to the business, enabling you to use exciting analytics tools. However, getting it wrong can be disastrous, especially as consumers become more aware of their rights.

The e-commerce industry is regulated by digital customer data privacy laws such as CCPA, Data Broker Registrations, and GDPR, among others. You must comply with the privacy laws applicable to your business to avoid potential legal penalties and reputational damage.

It’s easy to use your e-commerce platform to target consumers overseas, but before you do, be aware of the risks, responsibilities, and opportunities. For instance, by making small changes to your website (e.g., altering the currencies you accept), you may unintentionally open yourself up to liability under the laws of other territories.

2. Business Licensing

E-commerce businesses are often required to obtain various licenses to operate legally, and the specific types of licenses needed depend on several factors, including the nature of the business, the products or services sold, and the geographical location where the business operates.

Different regions or countries may have different regulatory requirements, such as sales tax permits, business licenses, and specific licenses for selling certain products (e.g., alcohol, pharmaceuticals, or food).

Additionally, businesses may need to comply with industry-specific regulations, such as data protection laws or consumer protection statutes. It’s important for e-commerce businesses to understand and secure all necessary licenses to ensure compliance with local, state, and international laws.

3. Business Insurance

Business insurance is a crucial component of risk management, providing financial protection and mitigating the potential impact of various unforeseen circumstances that could jeopardize the operations and assets of a company. It helps safeguard the business from lawsuits, property damage, theft, employee-related injuries, and other legal challenges.

For e-commerce companies to protect against risks such as legal liabilities, data breaches, and product issues. E-commerce businesses face unique challenges due to constant transactions, digital interactions, and the handling of customer data, making them particularly susceptible to legal and financial risks.

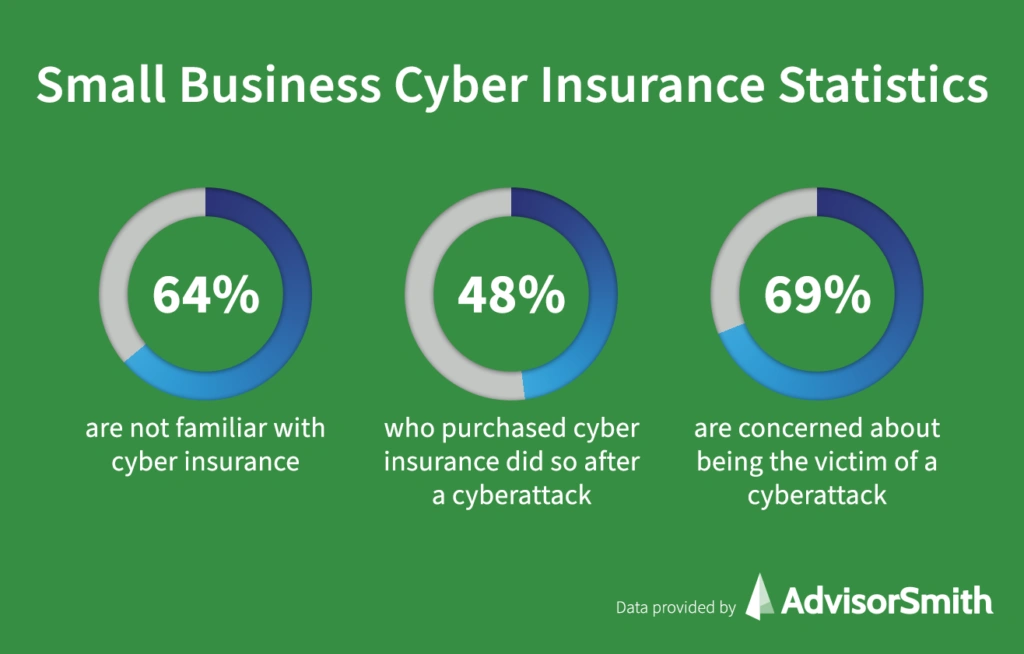

Here is a breakdown of how familiar small businesses are with cyber insurance:

- 39%: Not sure what cyber insurance covers.

- 25%: Do not know what cyber insurance is.

- 19%: Know what cyber insurance is, but have no plans to purchase.

- 17%: Have some form of cyber insurance coverage.

Advisor Smith

Key types of insurance for e-commerce businesses include:

- General liability insurance: Covers bodily injury, property damage, or advertising injuries.

- Professional liability insurance: Protects against claims for mistakes, failures, or subpar services, particularly for service-based businesses.

- Product liability insurance: Covers claims for defective products causing harm or injury.

- Cyber liability insurance: Protects against data breaches, cyberattacks, and related legal costs.

- Business interruption insurance: Provides compensation for lost income and expenses during operational disruptions.

- Workers' compensation insurance: Covers medical expenses and legal costs for employee injuries.

- Trade credit insurance: Safeguards against non-payment for goods or services, particularly in large or international transactions.

- Intellectual property (IP) insurance: Protects against IP infringement claims.

Securing the right coverage helps e-commerce businesses manage risk, ensure compliance with regulations, and protect their reputation, contributing to long-term success and stability.

4. Taxes

In the context of e-commerce businesses, taxation laws and standards vary by country and state, with the location of the business, the geographical areas it serves, and the nature of the goods or services it sells.

Sales Tax

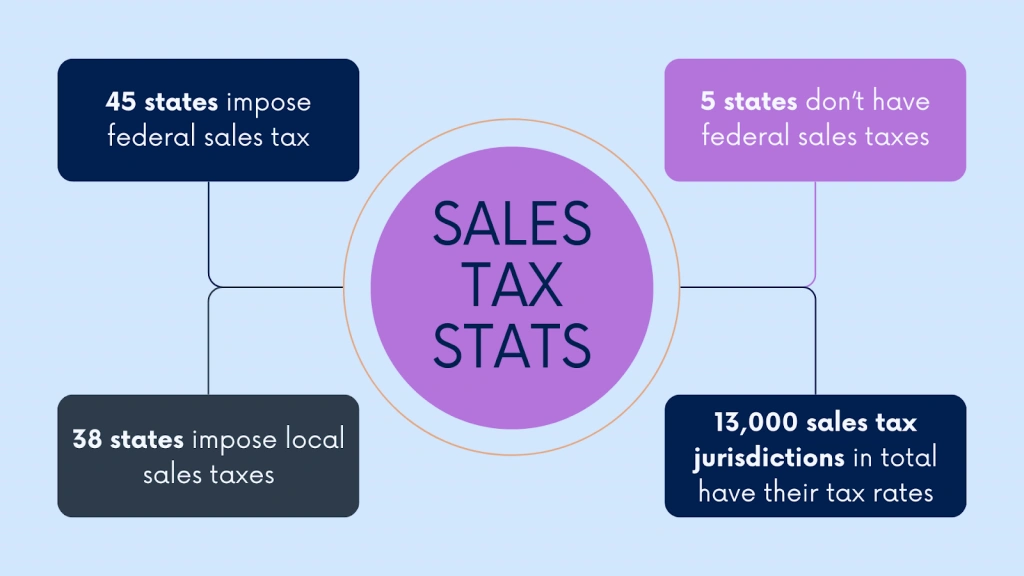

In many countries, businesses are required to collect sales tax on products sold to customers within certain jurisdictions. The U.S. has a total of about 13,000 sales tax jurisdictions, each with its own tax rates and regulations. Can you imagine that?

The specific tax rate and the applicability of sales tax depend on the location where the customer resides and the type of goods or services sold.

For example, in the United States, sales tax is typically governed at the state and local levels, meaning that tax rates can vary from one state or even city to another. Some states require sales tax for physical goods but exempt digital products or services, while others may impose taxes on both.

In some countries, such as the European Union, VAT (Value Added Tax) applies to e-commerce transactions. Businesses are required to charge VAT on goods or services sold to customers in certain EU countries, even if the business is based outside the EU. The VAT rate can vary depending on the country of the customer, and businesses must be familiar with the VAT rules in each country where they operate.

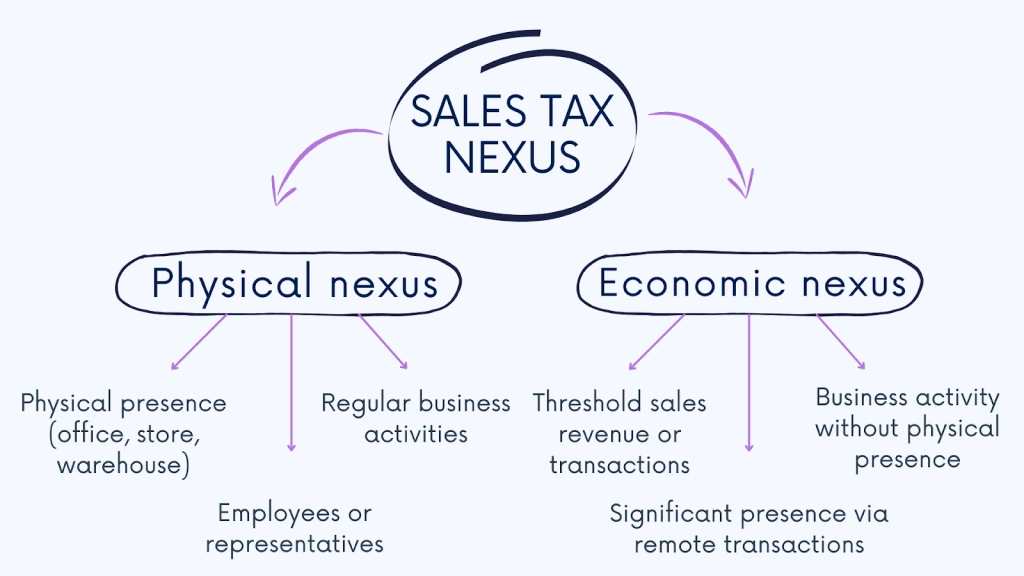

Nexus and Economic Nexus

Nexus refers to the connection or presence that a business must have in a specific jurisdiction for that jurisdiction to impose tax obligations. In traditional brick-and-mortar businesses, nexus is typically established when the business has a physical presence, such as a storefront or warehouse, in a given state or country.

However, with the rise of e-commerce, the concept of economic nexus has become more prominent. Economic nexus occurs when a business meets certain sales thresholds in a jurisdiction, such as reaching a specific amount of sales revenue or a number of transactions in a year. Even if an e-commerce business does not have a physical presence in a state or country, it may still be required to collect sales tax if it exceeds the threshold for economic nexus.

For example, in the United States, the South Dakota v. Wayfair Supreme Court ruling in 2018 established that states could require online retailers to collect sales tax if they meet certain economic nexus thresholds, even if the business does not have a physical presence in the state. This ruling has led to significant changes in how e-commerce businesses handle sales tax collection and compliance, as many states now have their own economic nexus laws with different thresholds.

Cross-Border Taxation

E-commerce businesses that sell internationally must navigate complex cross-border taxation rules, which vary significantly by country and may require businesses to register with foreign tax authorities, collect sales tax or VAT, and remit taxes to the appropriate jurisdictions.

Additionally, customs duties and import taxes may apply to physical goods sold internationally, which can impact pricing and shipping strategies. For instance, selling to European customers may require businesses to comply with the EU’s VAT system, while selling to Canadian customers may involve complying with the Goods and Services Tax (GST) or Harmonized Sales Tax (HST).

Many countries have tax treaties or agreements that aim to avoid double taxation for businesses operating in multiple jurisdictions. E-commerce businesses that operate internationally must be aware of these treaties and the rules regarding taxation in the countries where they do business.

Digital Goods and Services Taxation

The taxation of digital goods and services is a growing area of concern for e-commerce businesses, as many governments are updating their tax laws to include digital products. Examples of digital products include software, online subscriptions, downloadable music, and e-books.

In some countries, digital goods are subject to the same sales tax or VAT as physical goods, while in others, different rules may apply. For instance, the European Union imposes VAT on digital services and goods, and businesses selling digital products to EU customers must comply with the VAT MOSS (Mini One-Stop Shop) scheme, which allows businesses to report and remit VAT in a single country rather than in each member state.

State and Local Tax Incentives

In some cases, e-commerce businesses may be eligible for state or local tax incentives or exemptions. For example, certain states in the U.S. offer sales tax exemptions on specific products or services, or they may offer tax credits or rebates for businesses involved in certain activities, such as research and development, job creation, or eco-friendly initiatives.

E-commerce businesses should be aware of any tax incentives available in the states or regions where they operate and factor these into their tax planning and strategy. The five states that don’t have sales taxes are Alaska, Delaware, Montana, New Hampshire, and Oregon.

Digital Taxation Compliance Tools

Given the complexity of e-commerce tax compliance, many businesses use digital tools and platforms to manage tax collection and remittance. Software solutions can help automate the process of calculating sales tax, VAT, and other taxes for each transaction, ensuring that businesses comply with local tax laws across different jurisdictions. Additionally, these tools can track changing tax rates, manage tax reporting, and help businesses stay up to date with the latest changes in tax legislation.

Penalties for Non-Compliance

Non-compliance with tax laws can result in severe penalties, including fines, back taxes, and interest on unpaid taxes. In some cases, tax authorities may conduct audits of e-commerce businesses to ensure they are complying with sales tax or VAT collection requirements. E-commerce businesses that fail to comply with local, state, or international tax regulations may face legal action, which can damage their reputation and financial stability.

5. Federal Trade Commission Act (FTCA)

The Federal Trade Commission Act (FTCA) is a critical piece of U.S. legislation that protects consumers from deceptive, fraudulent, and unfair business practices, including false advertising. Enacted in 1914, the FTCA established the Federal Trade Commission (FTC), a government agency responsible for enforcing laws related to consumer protection and antitrust issues.

The FTCA plays a vital role in ensuring that businesses engage in fair practices, providing consumers with the confidence that the products and services they purchase are accurately represented and free from misleading claims. Key Aspects of the FTCA in Consumer Protection:

Prohibition of Deceptive Practices

Under the FTCA, businesses are prohibited from engaging in deceptive practices that can mislead or harm consumers. Deceptive practices include false or misleading statements, representations, or omissions in connection with the sale of goods and services.

For instance, if an e-commerce business makes claims about a product’s effectiveness or quality that are not substantiated by evidence, such as claiming a product can cure a disease without scientific proof, it would be considered a violation of the FTCA.

False Advertising

The FTCA specifically targets false advertising, which includes the dissemination of misleading or untruthful messages about products or services through any medium, such as print, radio, television, or online platforms. Online businesses, including e-commerce stores, must be particularly careful when advertising their products on websites, social media, and other digital platforms.

Claims such as “limited-time offers,” “free trials,” or “100% satisfaction guaranteed” must be substantiated with clear terms, conditions, and factual backing. The FTC requires that all advertising be truthful, not misleading, and based on evidence that can be verified.

Unfair Trade Practices

The FTCA also addresses unfair trade practices, which are business practices that cause harm to consumers that outweigh the benefits to consumers or competition. These practices include actions that result in significant consumer harm, such as price gouging, monopolistic tactics, or abusive customer treatment.

For example, an e-commerce business that suddenly raises prices after a natural disaster without any legitimate reason could face enforcement actions under the FTCA. Additionally, businesses that make it difficult for consumers to cancel subscriptions or return products after an unfair or misleading promotion could also fall under the FTC’s scrutiny.

Substantiation of Claims

The FTCA requires businesses to substantiate any claims made about their products or services. For instance, a company claiming that its product helps customers lose weight must have reliable scientific evidence to support this claim. The law applies to both express and implied claims, meaning that even if a business doesn’t explicitly advertise a claim, but the promotion implies something about the product’s benefits, it still needs to be truthful.

E-commerce businesses are particularly vulnerable in this area, as online consumer reviews, social media promotions, and influencer marketing can sometimes blur the line between legitimate claims and misleading content. The FTCA mandates that businesses provide clear evidence for any claims they make, and failure to do so can lead to penalties and corrective actions.

Consumer Redress and Enforcement

The FTCA empowers the FTC to take enforcement actions against businesses that violate its provisions. This includes investigating consumer complaints, conducting audits, and issuing fines, penalties, or cease-and-desist orders.

If a business is found to have engaged in deceptive or fraudulent practices, the FTC may require the company to provide refunds, compensations, or other forms of redress to consumers who have been harmed by the false advertising or fraudulent conduct. E-commerce businesses that fail to comply with the FTCA risk facing legal consequences that can significantly damage their reputation and financial stability.

Online Business Considerations

The rise of digital commerce has presented new challenges for consumer protection. The FTCA applies to e-commerce businesses just as it does to traditional brick-and-mortar businesses. E-commerce businesses are required to ensure that their online advertising, product descriptions, and terms and conditions comply with FTCA regulations.

For example, online businesses must clearly disclose shipping charges, return policies, and product limitations, and they must avoid using “clickbait” tactics that mislead consumers into making purchases. Additionally, e-commerce platforms should take care when using customer testimonials or influencer endorsements, ensuring that all statements made are genuine and supported by evidence.

Enforcement and Penalties

The FTC has broad enforcement authority under the FTCA. When a violation of the Act occurs, the FTC can take a variety of actions, including issuing fines, forcing the company to cease the deceptive behavior, and requiring corrective advertising. The penalties for violating the FTCA can be severe, with fines that can reach up to thousands of dollars per violation.

In some cases, the FTC may also require businesses to implement compliance programs to prevent future violations. Additionally, the FTC works closely with other government agencies, state attorneys general, and consumer advocacy organizations to enforce consumer protection laws.

Impact on E-Commerce Regulations

E-commerce businesses are subject to various online-specific rules and guidelines that aim to protect consumers in the digital space. This includes the need for transparency, truthful product descriptions, clear terms and conditions, and easy-to-understand return and refund policies.

The FTCA requires e-commerce businesses to ensure that online practices, including sales tactics, promotional offers, and subscription models, are transparent and compliant with federal regulations. As digital marketing continues to evolve, businesses need to stay updated with FTC guidelines and best practices to avoid false advertising and unfair practices online.

6. Legal Documents

This session includes documents that are commonly embedded on eCom websites for web visitors to read.

Privacy Policy

A transparent privacy policy can help build customer trust and make them more likely to share information and complete purchases.

Focuses on how a company handles user data, including how it’s collected, used, and protected. Privacy policies are often legally required and help businesses comply with data protection laws.

- How personal data is collected and why

- Whether personal data is shared with third parties

- How personal data is kept secure

- Data retention periods

- Data subject rights

- Purpose: A privacy policy protects users' rights, while terms and conditions protect the rights of the business or service provider

- Content: A privacy policy addresses data privacy concerns, while terms and conditions cover usage rules, intellectual property, and legal liabilities.

- Legality: Privacy policies are often legally required, while terms and conditions are not legally mandatory.

Terms and Conditions

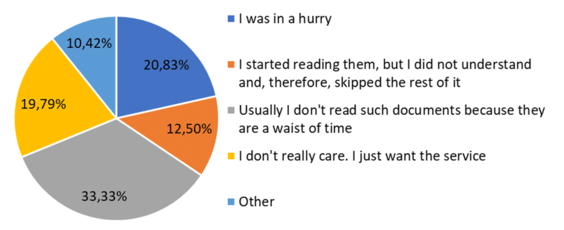

-Answers to Question “Why haven’t you read the terms and conditions?” (Only Responders Who Answered the Previous Question that They Did Not Read the “Terms and Conditions” Were Asked)

The Consumer Rights Act 2015 says goods must be as described, fit for purpose, and of satisfactory quality. During the expected lifespan of the product, the customer is entitled to the following:

- Up to 30 days – If the goods are faulty, a full refund

- Up to 6 months – If it can’t be repaired or replaced, a full refund in most cases

- Up to 6 years – If the goods do not last a reasonable length of time, some money back

As per the Consumer Contracts Regulations 2013,

- A consumer who purchases goods online has up to 14 days after receiving their goods (in most cases) to change their mind and be offered a full refund

- The customer can cancel a service within 14 days. If they have agreed that the service will start within this timeframe, the customer can be charged for what they have used during that period

- If the digital content is faulty, and cannot be repaired, the customer can get a full or partial refund

Nicholas Campion, Director, Company Secretarial at QCF

The terms and conditions of sale and refund policy for a product or service are related, as the refund policy is a part of the sales transaction’s rules.

- Terms and conditions of sale: These are the rules that govern a sales transaction, including payment terms, discounts, and other features.

- Refund policy: Also known as a return policy, this document informs customers about how a company handles returns and refunds. It should include clear, concise information about the time frame for returns, the conditions for accepting returns, and how refunds are issued.

Return Policy

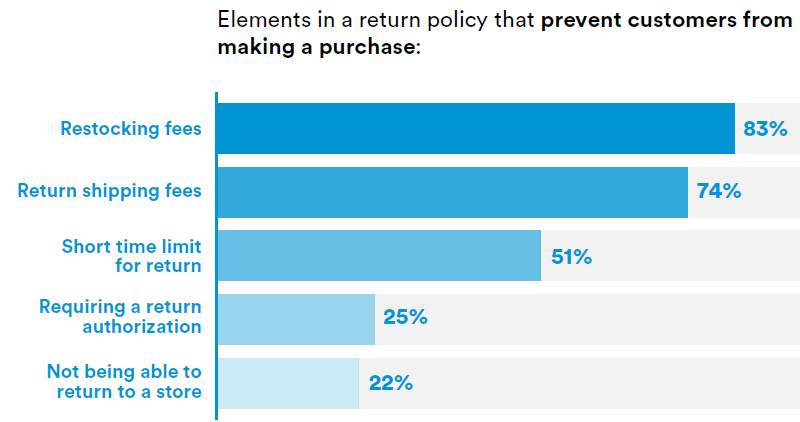

Be transparent about returns. Customers prefer to see your returns policy outlined in a separate document, so align your website with customer expectations as quickly as possible. The law also requires you to provide cancellation forms and clearly communicate how the returns process works. This information should be included in your terms and in the emails you send to customers as part of the order process.

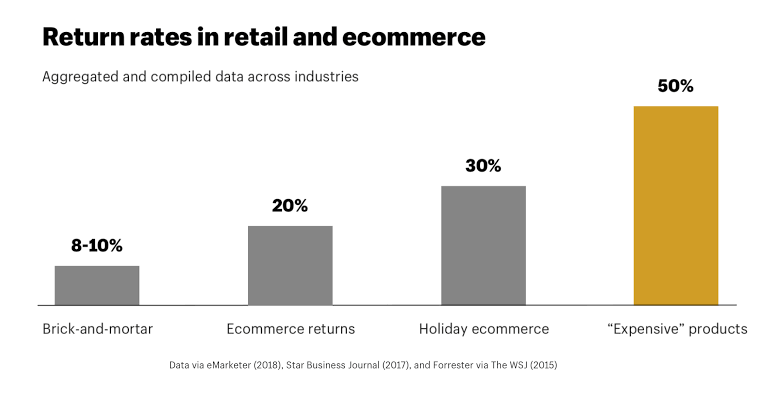

Remember, if you want the customer to pay for the return costs of non-faulty items, you should make this clear at the outset. Also, keep in mind that in the online environment, consumers can return goods even when they are not faulty, with very few exceptions, simply because they have changed their mind. Below, the chart shows that shoppers’ behavior conditioned by your refund policy.

Companies are not legally obligated to offer refunds or returns, and customers do not have a legal right to a refund if they change their mind. However, most businesses do offer refunds in such circumstances.

Nicholas Campion, Director, Company Secretarial at QCF

You must have effective processes in place to communicate with your consumers at every step of the journey. Much of this can be automated through emails, and designated account areas are a common way to manage this. You should inform them when you are taking payments and when you are shipping goods. Additionally, you should provide a cancellation form and your returns policy. Make sure they can easily find all the information they need at a glance.

- Who they are dealing with

- Their rights if things go wrong

- How much they are going to pay

- When they are going to receive the goods

If you don’t have a return policy in place, your customers can return items for a refund or exchange within a set time frame after purchase. When writing a return policy, you can review federal and state laws, understand common types of return fraud, and list eligible products and services. A return policy typically has:

- Time frame: It's a time limit between 14 and 60 days after purchase. However, the time frame can vary depending on the product, whether it was purchased online or in-store, and how long shipping takes

- Conditions: It outlines the conditions under which a product can be returned, such as if it's in its original packaging and condition

- Compensation: It outlines how the customer will be compensated, e.g., with a full refund or store credit

- Fees: A return policy may mention any fees associated with returning or exchanging items.

- Identification or receipt: A return policy may state your identification or receipt requirements

In most jurisdictions, it's not legally required to have a return and refund policy. However, having a policy can help build trust with customers, reduce confusion, set expectations, and reduce purchase hesitation.

John Lister, Legal writer at FreePrivacyPolicy

You cannot remove or restrict consumers’ legal rights to return goods or services or refuse to provide a refund, replacement or repair that contravenes their statutory rights. It is also a criminal offence under the Consumer Protection from Unfair Trading Regulations 2008 to mislead consumers about their statutory rights. For example, you cannot state the following:

- No refunds given

- No refunds given except where goods are faulty

- Goods can only be exchanged

- Only credit notes will be given against faulty goods

- Sold as seen

The above types of statements are prohibited, even if you included a disclaimer such as ‘Your statutory rights remain unaffected’. This would be misleading so just don’t do it!

- Customer rights: A returns clause can give customers additional rights beyond their statutory rights. However, you can't usually include terms that reduce or remove a customer's statutory rights.

- Promises: Make sure you're prepared to abide by any promises you make in your returns clause.

- Acceptance: Make it clear when you won't accept returns.

- Confidence: A return and refund policy can help build trust with customers.

Shipping Timelines and Delivery Terms

How you dispatch goods and when you take online payments matter a lot. For instance, taking payments for goods that you are not yet ready to dispatch can create major headaches for your e-business, especially if your customer later tries to cancel their order.

This issue is common in e-commerce stores based on the dropshipping model, stemming from poor inventory management. Be careful with stock control. Learn seven inventory management techniques to maintain optimal stock levels:

- Calculate your inventory turnover ratio

- Run an ABC inventory analysis

- Avoid just-in-time inventory

- Plan your seasonal inventory

- Stay on top of your 3PL inventory

- Install an inventory control system

- Switch to perpetual inventory as soon as possible

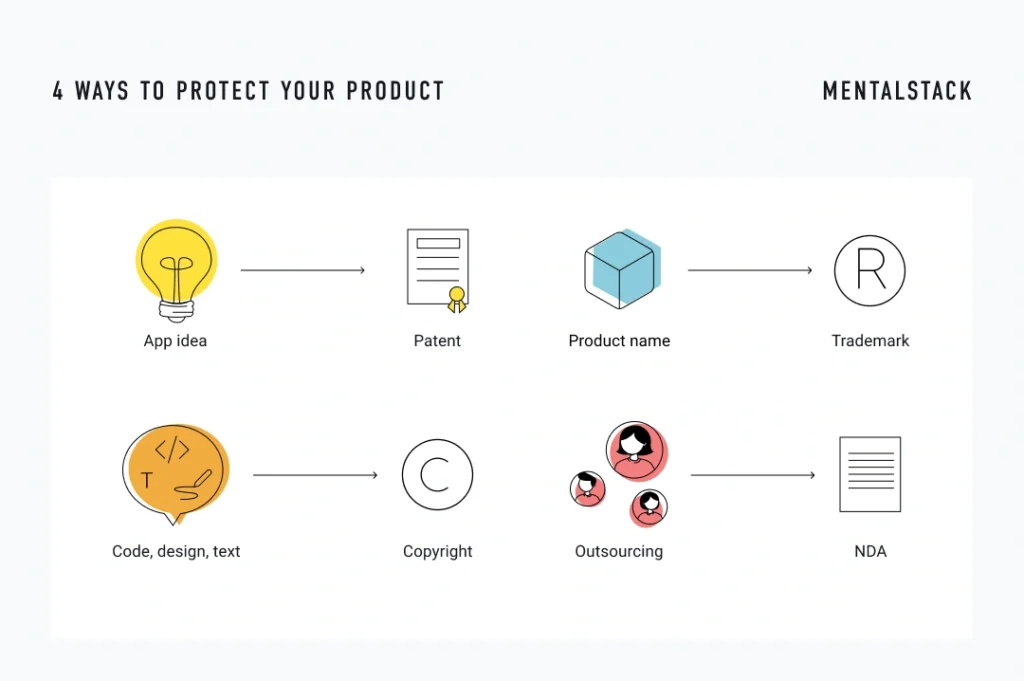

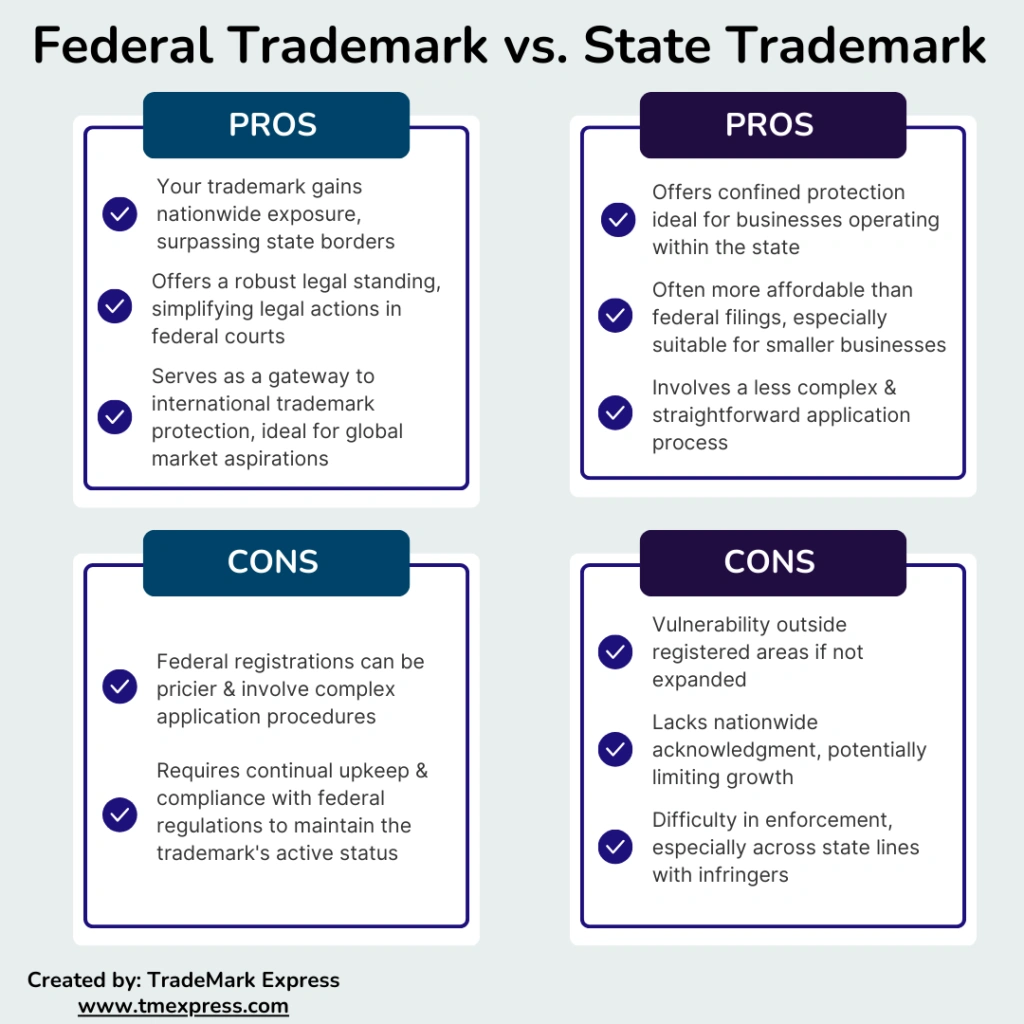

Intellectual Property

You could easily find yourself falling foul of intellectual property laws in e-commerce. For instance, if you are selling a branded product registered in the U.K. but not registered overseas, and you ship to territories outside the U.K., you could be committing an intellectual property infringement.

Do your research, understand the laws in the territories you plan to ship to, and take advantage of the opportunities while staying on the right side of the law.

Let’s suppose you want to sell t-shirts with Star Wars characters on them, you will need to obtain the appropriate consents to avoid any legal issues. Similarly, you may be afforded legal protections that prevent other brands from using your intellectual property without your consent.

Here’s how the United States Patent and Trademark Office categorizes intellectual property:

- Trademark: A word, phrase, symbol and/or design that identifies and distinguishes the source of the goods of one party from those of others

- Patent: A limited duration property right relating to an invention, granted by the U.S. Patent and Trademark Office in exchange for public disclosure of the invention

- Copyright: Protects works of authorship, such as writings, music and works of art that have been tangibly expressed

Companies are not legally obligated to offer refunds or returns, and customers do not have a legal right to a refund if they change their mind. However, most businesses do offer refunds in such circumstances.

Nicholas Campion, Director, Company Secretarial at QCF

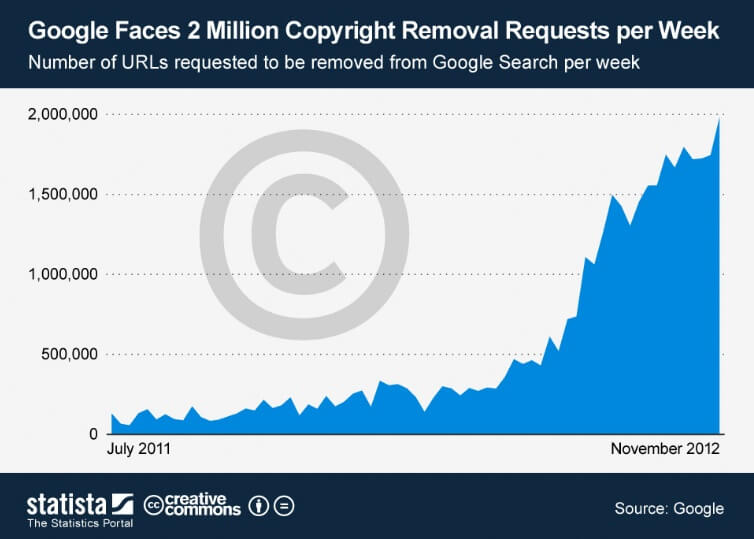

Google regularly receives requests from copyright owners to remove search results that link to copyright-infringing material. In the week of November 5, Google received 1.98 million such requests, an all-time high and a tenfold increase from one year ago.

Among the top reporting organizations are the Recording Industry Association of America, the British Recorded Music Industry, NBC Universal, and several companies specializing in copyright protection. The RIAA alone reported more than 4.5 million infringing URLs to Google.

In August 2012, Google announced a change to its search algorithm that would penalize domains that had been validly accused of infringing copyright. While content owners welcomed the decision, others were skeptical and feared that many websites could be de-ranked based on unjustified copyright claims. Nowadays, Google still prioritizes relevant and unique content to rank websites.Felix Richter, Data Journalist at Statista

7. Comply with Marketing Regulations

Your web content and social media posts are both forms of marketing, and as such, they need to comply with marketing regulations. For instance…

- If you make statements about your business' products or services, be sure they are open, honest and transparent.

- If you make comparisons between your business and another one, be sure it is fair and in compliance with the rules. Don't fall foul of any trademark legislation.

- If you make objective statements that can be assessed, be sure you've the evidence to back them up (e.g., if you say that product X is the most popular line you need to have the evidence to statistically prove this).

- If you publish posts in social media, make it clear if there is a commercial connection between the person making the post and the post (e.g. a business owner posting about how great their business is could soon come into hot water if he doesn't make it clear that he is the business owner).

Other laws that apply to e-commerce websites include:

- Liability limitations

- Jurisdictions

- Payment terms

- Dispute guidelines and process

Hopefully, this article has helped you understand how online compliance can keep you on the right side of the law, give you a competitive edge, and reduce your risk when managing an online business.